Zamp makes global finance ops effortless

Cash Copilot

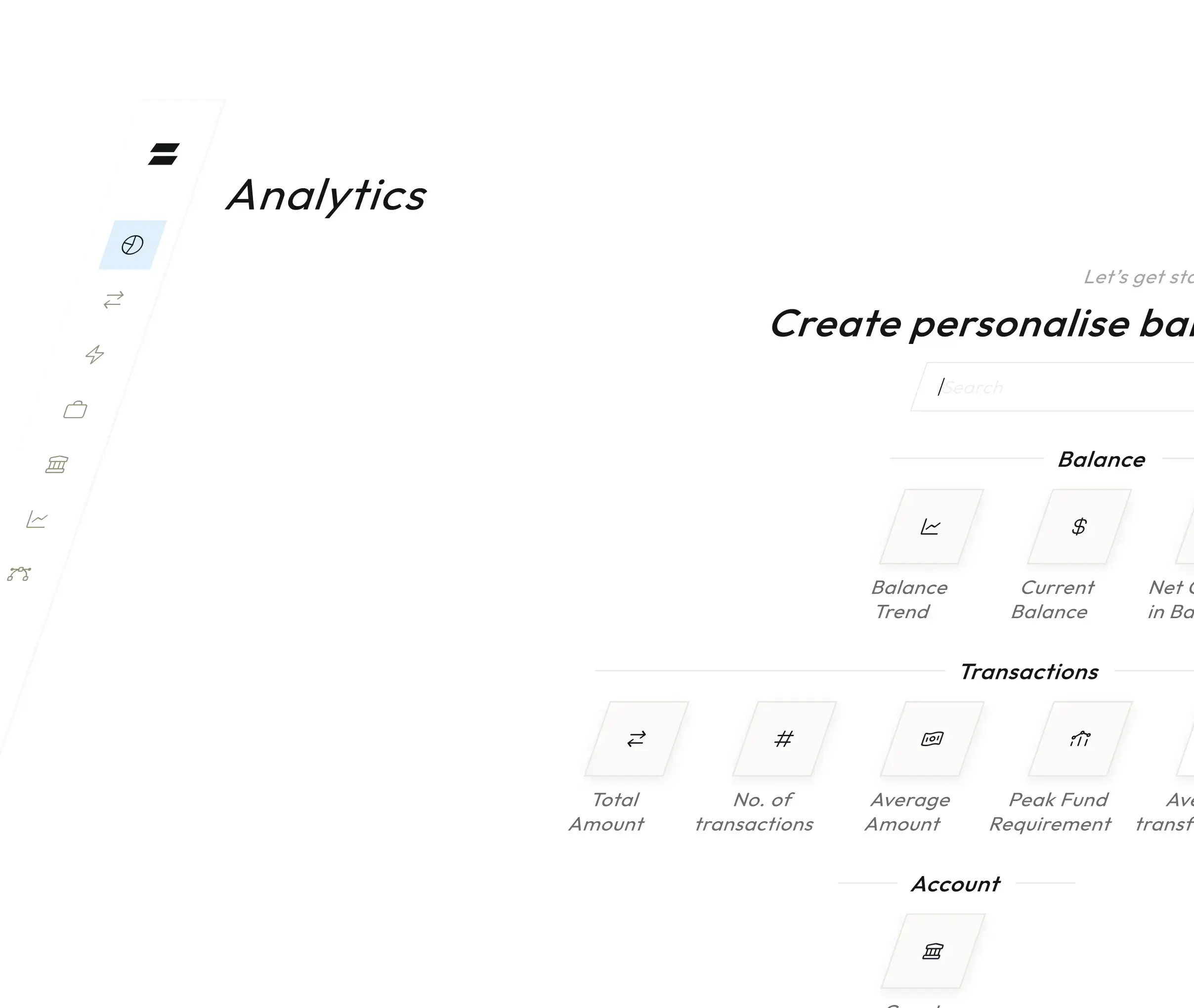

Attain complete visibility over your cash, create real-time forecasts, and setup automated cash-sweeps to improve working capital utilisation

Reconciliation

Move faster, and improve accuracy by automating reconciliation at scale

Payments Command Centre

Gain control of, streamline, and secure your global payment execution process

Unified Payments API

One seamless, and modern API for product and engineering teams to move faster with payments from any bank globally

Zamp makes global finance ops effortless

Cash Copilot

Attain complete visibility over your cash, create real-time forecasts, and setup automated cash-sweeps to improve working capital utilisation

Reconciliation

Move faster, and improve accuracy by automating reconciliation at scale

Payments Command Centre

Gain control of, streamline, and secure your global payment execution process

Unified Payments API

One seamless, and modern API for product and engineering teams to move faster with payments from any bank globally

“We have over 200 bank accounts, and need to make thousands of payments daily to our merchants. We needed an intelligent, and easy to implement solution to move faster. Zamp has been instrumental in helping us deliver a superior customer experience”

Vishnu Katara

CFO, Noon.com

Drive Success and Deliver Results

Make your money work

Reach 0 idle cash at the end of every day, so you can make the most out of your capital

Focus on more strategic tasks

Automate manual processes, minimise inefficiencies, and dedicate your time to achieving better results for your company.

Significantly reduce risk

Gain control of your finances with in-depth access control, audit logs, automatic reconciliation, alerts, and real-time analytics

Build for the modern times

Complete Flexibility

Customise Zamp to meet your business’s requirements, in minutes rather than weeks or months

Robust Automation

Setup custom workflows, automate manual tasks, save time and money

Rapid no-code Implementation

Instantly activate select capabilities & attain full operational status in under 4 weeks, with no engineering effort required

Complete Control

We enable real-time, 2 way connectivity with all your financial systems, so you can monitor, optimise, reconcile, and forecast from one place.

“We now have real-time visibility into cash across all our entities and banks. In addition, we have been able to optimise yield on idle cash, forecast cash flow and plan for the future very seamlessly”

Harshal Kamdar

CFO at PeakXV Partners

(formerly Sequoia Capital India)

Get Started

Schedule a call with our team to learn more about how you can streamline your finance ops